Do Medicare Supplement Plans Have In- and Out-of-Network Providers?

Will my preferred doctor accept my Medicare Supplement coverage? Do I have to select a specific provider to ensure my services are covered? Do Medicare Supplement plans even have in-network providers?

If you’ve found yourself asking any of these questions, you’re not alone.

Once you've finally figured out which Medicare plan may be right for you, it can sometimes feel like there are even more unknowns waiting on the other side. Fortunately, you’re in the right place.

With decades of experience with all things Medicare, the Medicare Allies team is ready to give you all the answers to your questions about Medicare Supplement networks.

Do Medicare Supplement plans have networks?

Fortunately, no – Medicare Supplement plans do not have provider networks.

Although private companies provide Medicare Supplement plans, they do not have networks of accepted doctors, because these plans work with Original Medicare.

If you have a Medicare Supplement plan, you can receive covered care from any doctor that accepts Medicare.

Does Medicare have in-network providers?

While Medicare doesn’t have traditional networks, providers do have to accept Medicare assignment in order for Medicare-approved amounts for care and services to be covered.

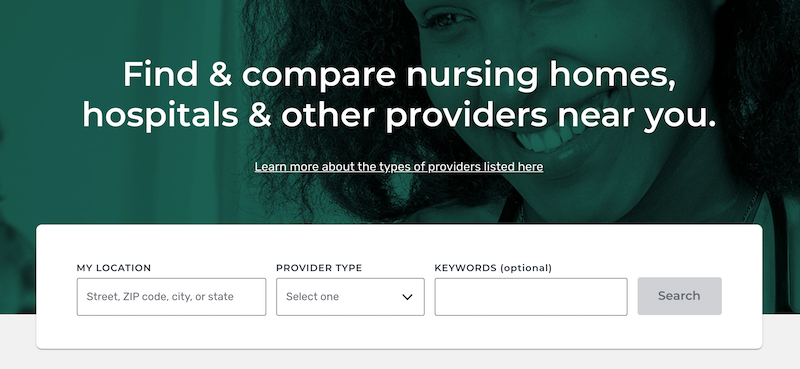

If you are curious about your doctor or specialist and want to know whether they will be covered by your Medicare or Medicare Supplement plan before you pay them a visit, give Medicare Care Compare a whirl.

This handy tool allows anyone to use their location and desired provider type to search for doctors and specialists that Medicare covers.

Can I receive care from a provider that does not accept Medicare?

The short answer is yes, you can receive care from a provider, even if they don't accept Original Medicare.

However, you will likely incur far greater costs than you would if you went to a provider that did accept Medicare. The costs will depend on a few different factors, including which Medicare Supplement plan you have and the extent that the medical provider is willing to work with Medicare.

If you have Medicare Supplement Plan N, you may be subject to Part B excess charges if your doctor does not accept Medicare. In most states, medical providers that do not accept Medicare are allowed to charge 15% more than Medicare-approved rates.

For example, if Medicare said that they would reimburse a doctors visit up to $100, that office could then bill you for another $15, which would be your excess charge.

Excess charges are rare and often very minimal when they do happen. Additionally, they are relatively easy to avoid by checking that your doctor is Medicare-approved before your appointment.

Alternatively, if your medical provider has wholly opted out of Medicare, the excess charge policy does not apply, and you would be responsible for all costs at whatever price the doctor’s office chooses to charge for.

Again, this situation is rare and, most often, avoidable by checking the approved status of your doctor beforehand.

Read more: Are Medicare Supplements Worth It?

How do I know if my doctor accepts my Medicare Supplement plan from my specific carrier?

Because Medicare is a federally regulated program, Medicare Supplement plans are all also standardized, even though they come from a private carrier.

Whether you chose a small mom-and-pop or a nationwide carrier, your Medicare Supplement plan will have the same coverage as anyone else’s. Therefore, you will be able to receive covered care at any doctor who accepts Medicare.

One of the best things about Medicare Supplement plans is their wide range of coverage. In fact, a recent study concluded that over 90% of primary care doctors in America accept Medicare.

With Medicare Supplements (also called Medigap plans), you have the freedom and flexibility to visit almost any doctor and receive care in most hospitals across the country.

Whether you are a traveler comforted by the flexibility of a Medicare Supplement or a homebody that appreciates peace of mind, Medigap can be a great option compared to other plans with stricter networks, such as Medicare Advantage.

Conclusion

If you would like to cut your Medicare costs and start filling in your coverage gaps, a Medicare Supplement may be right for you.

Contact us today to get a free quote.

Estimate Your Monthly Medicare-Related Insurance Premiums

Are you feeling in the dark about your potential Medicare costs? Find out exactly how much Medicare will cost you per month with the interactive Medicare Cost Worksheet.

Download Yours Now

Our team of dedicated, licensed agents can help you as little or as much as you need. Whether it’s answering a few questions about Medicare or creating a comprehensive Medicare Planner with you, we are your Senior Allies.

Email Us Now