Are you Medicare eligible? Gain more control over your healthcare with a Medicare Medical Savings Account (MSA). An MSA is a $0 premium health plan combined with high-deductible health coverage and a special medical savings account.

Money is deposited into your account, and you decide what healthcare services to spend it on. There are no provider networks, and once you reach your plan deductible, 100% of your Medicare-covered expenses are paid for. It’s Medicare, well spent.

What Is An MSA?

When you turn 65, it’ll be time to decide what your Medicare healthcare plan will be. Have you ever considered a Medicare MSA?

The MSA is a hot buzzword right now, because it’s a very compelling alternative to Original Medicare coverage. An MSA, or a Medical Savings Account, combines high-deductible health coverage with a special savings account that’s funded annually.

We've been recommending Medicare plans to our clients for over 30 years now, and we can confidently say that this is one of the most consumer-friendly options in the Medicare space. In fact, we have agents with us that have been selling insurance for decades, and they’ve said, “This is the product I’m going to choose when I turn 65.” That’s really saying something!

Read More: This New Medical Savings Account is a Compelling Medicare Alternative

Why Choose An MSA?

As we get closer to aging into Medicare, it’s important to understand your healthcare options. With an MSA, you don’t have to worry about small provider networks or high monthly premiums.

With an MSA, you have choices. See your favorite doctors and even use your special deposit, funded by the government, on qualified medical expenses that Medicare won’t cover, like eyeglasses and dental work.

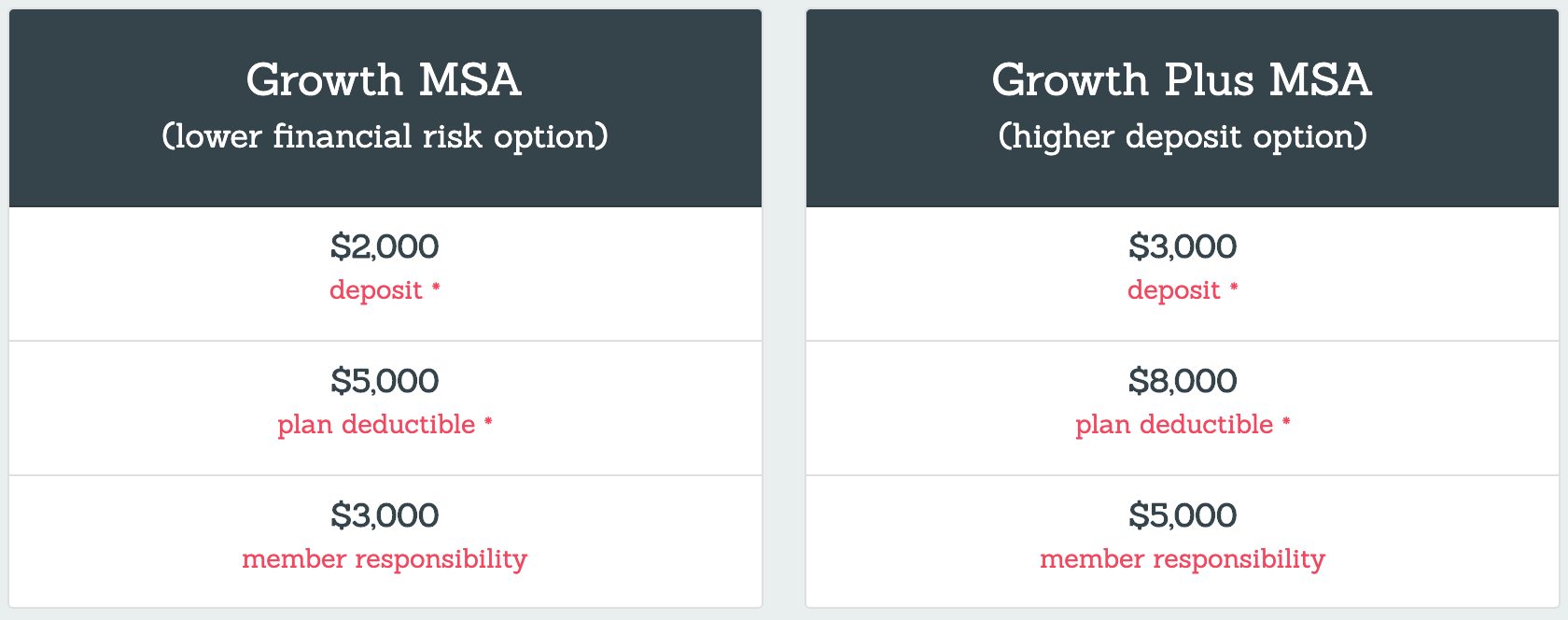

2021 Plan Information

- $2,000 or $3,000 Deposit

- $5,000 or $8,000 Deductible

- $3,000 or $5,000 Member Responsibility

Ultimately, the deposit that comes with an MSA plan is yours to spend, move to your own bank, and/or invest.

Read More: Is a Medical Savings Account (MSA) Better Than a Medigap Plan?

Want to Learn More About MSAs In Your Area?

We can help you compare your current health plan to this brand new Medical Savings Account (MSA). Our help is always free of charge.

Simply fill out the form below to get started!